IT Audit An in-depth analysis of Korea's consolidated ICFR and the New External Audit Act

23-04-19

본문

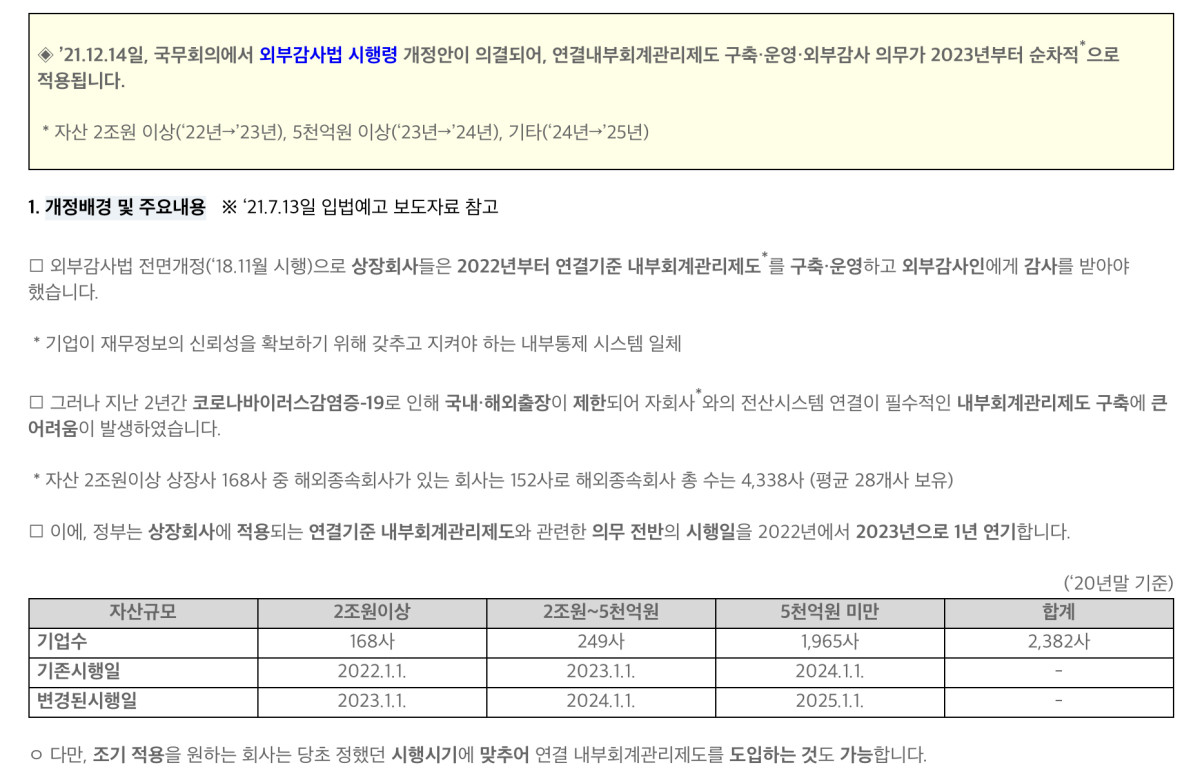

Consolidated internal control systems are an integral part of a company's financial reporting practices. However, due to the COVID-19 pandemic, business travel both domestically and overseas has been restricted, creating significant challenges for the establishment of internal control systems that require the connection of computer systems with subsidiaries. In Korea, the mandatory requirement for a consolidated internal control system has been suspended for one year, but audits of internal control systems for listed companies are being implemented in stages.

Source: Financial Services Commission of Korea

In this post, we'll take a look at the new external audit law on internal control over financial reporting in Korea, and highlight some of the key points that will help you prepare for or respond to an audit of consolidated financial statements.

The importance of consolidated financial statements

Consolidated financial statements provide a comprehensive view of the parent company and its subsidiaries, which is essential for assessing the financial health of an organization, complying with regulatory requirements, and providing important information to stakeholders.

The need for a consolidated audit

The consolidated audit plays an important role in ensuring the accuracy and reliability of the consolidated financial statements. The consolidated audit evaluates the effectiveness of the internal accounting control system and increases stakeholder confidence in the company's financial reporting.

Key factors to consider in consolidated financial statements and audits

To help readers better understand the principles of consolidated financial statements and auditing in Korea, I have compiled 15 key factors to consider to the best of my knowledge. I have provided examples to make the information as clear and easy to understand as possible.

1. Intermediate Holding Company Scope:

Consolidated financial statements should include the financial data of all intermediate holding companies to provide a comprehensive view of the group's financial performance.

2. Full Scope for Intermediate Control Companies:

When an intermediate control company has a significant impact on the group's consolidated financial statements, it should be subject to a full scope audit to ensure accuracy and transparency.

3. No Specific Percentage for Sufficiency:

Korean regulations do not specify a percentage threshold for determining the sufficiency of a consolidated financial statement. Companies must assess the materiality of their subsidiaries based on qualitative and quantitative factors.

4. Alternative Controls and IT Systems:

If a company's internal accounting control system is not sufficient, alternative controls and IT systems should be considered to enhance the accuracy and reliability of the financial statements.

5. IT Systems and Financial Reporting:

Companies should ensure that their IT systems are effective in supporting financial reporting and maintaining the integrity of the financial data.

6. Obligation for Consolidated Internal Accounting Control System:

Parent companies are required to establish and maintain a consolidated internal accounting control system that covers all significant subsidiaries.

7. Scope Selection:

Companies should carefully select the scope of their consolidated financial statements and audits based on the materiality of the subsidiaries, the risks involved, and the requirements of the relevant regulations.

8. Applicable Standards for Subsidiaries:

Subsidiaries should apply the same accounting standards as the parent company, ensuring consistency and comparability in the consolidated financial statements.

9. Separate Legal Entities:

Consolidated financial statements should reflect the fact that the parent company and its subsidiaries are separate legal entities, and intercompany transactions should be eliminated.

10. Significant Part of Consolidated Financial Statements:

The parent company must determine which subsidiaries constitute a significant part of the consolidated financial statements based on factors such as size, risks, and complexity.

11. Scope of Management's Evaluation:

Management should evaluate the effectiveness of the consolidated internal accounting control system, considering the materiality and risks associated with the subsidiaries.

12. Account Class Level for Scoping:

Companies should consider the account class level when determining the scope of their consolidated financial statements and audits, focusing on accounts that are most susceptible to material misstatement.

13. Criteria for Determining Asset Size:

Companies should establish clear criteria for determining the size of their assets and liabilities, ensuring that the consolidated financial statements accurately reflect the group's financial position.

14. Risk Assessment:

Companies should conduct a thorough risk assessment of their subsidiaries to identify potential issues that may impact the accuracy and reliability of the consolidated financial statements.

15. Audit Planning and Execution:

Companies should work closely with their auditors to plan and execute the consolidated audit, ensuring that all significant risks are addressed, and the audit objectives are achieved.

While my discussion is specific to Korea's internal control over financial reporting, it may also be relevant to other countries looking to improve their financial reporting practices, or to companies that need to respond to them. While it's important to understand your country's specific regulations and requirements, the core principles of transparency, accuracy, and stakeholder engagement can be applied universally.

Conclusion

Understanding consolidated financial statements and audits in South Korea and their broader implications is critical for companies looking to improve their financial reporting practices. By following these guidelines and actively engaging with their auditors, companies can increase the accuracy of their financial reporting, reduce risk, and ultimately benefit all stakeholders.